Travel Insurance | Pet Insurance | Insurance Protection

Types of Insurance: Insurance plays a vital role in financial defense in contradiction of unexpected proceedings and dangers. It proposes persons and trades concord of attention by minimalizing. The monetary impact of chances, diseases, compensations, or some other unforeseen incidences. There are numerous kinds of insurance obtainable.

Search the rich history and evolution Introduction of insurance in the United States. From its origins in marine insurance in the 1600s to the compound business, it is today. Insurance has been modified to see society’s wants. Contribution monetary guard to individuals and businesses. Learn in what way insurance premiums, and claims. Deductibles effort to protect our upcoming.

Each is intended to cover exact wants and circumstances. Empathetic to these dissimilar kinds of insurance is vital. To make knowledgeable selections about your attention. Below, we travel the most common types of insurance.

Health Insurance

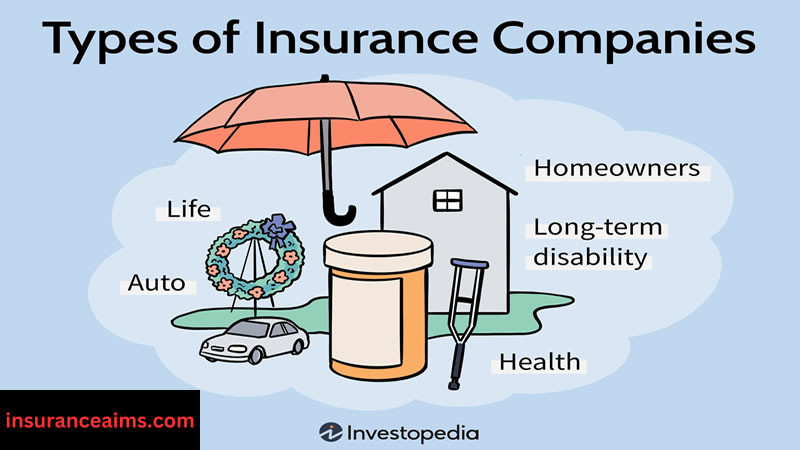

Types of Insurance; Health insurance is one of the most significant types of attention for individuals and families. It benefits to cover the price of medical care. Including doctor visits, hospital stays, surgeries, medicine medicines. Other healthcare-related payments. In many nations, health insurance is vital for retrieving quality.

Healthcare is deprived of facing crushing prices. Health insurance tactics can vary in analysis and price. Some tactics are employer-sponsored. While others are bought confidentially or from side-to-side administration agendas like Medicaid or Medicare.

Payments, deductibles, and co-pays are important mechanisms. That touches the price of health insurance. Contingent on the strategy, it may also shelter defensive facilities. Like inoculations and broadcasts, endorsing general well-being.

Life Insurance

Types of Insurance; Life insurance is intended to deliver financial provisions to your recipients afterward your demise. It safeguards that your precious ones are monetarily protected. Particularly in the occasion that you are the main employee in the domestic. There are two chief types of life insurance. Period life insurance and enduring life insurance.

Term Life Insurance: This kind of insurance covers an exact period, typically 10, 20, or 30 years. If the policyholder expires throughout this term. The recipients obtain an outgoing. However, if the policyholder outlasts the period, no welfare is provided.

Permanent Life Insurance: This type of insurance delivers reporting for the policyholder’s complete lifetime. as extended as premiums are salaried. It also comprises an investment constituent that can accrue money worth over a period. Which policyholders can copy counter to or remove?

Auto Insurance

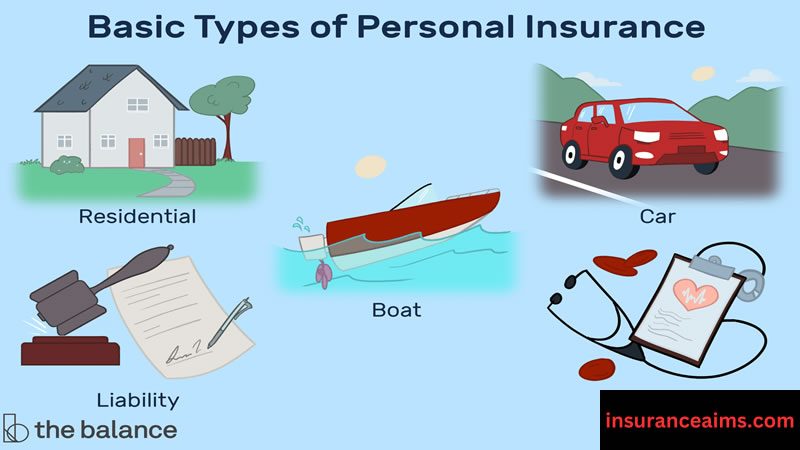

Types of Insurance; Auto insurance is a kind of insurance that delivers monetary defense counter to injury or wound after car accidents. It is obligatory in most seats for passengers to have at least a level of auto insurance attention to function a vehicle lawfully. Auto insurance classically includes numerous mechanisms.

Liability Coverage: This wages for compensations or wounds produced to others in a chance that is thought to be your responsibility. It may shelter medicinal expenditures. Property damage, and legal dues.

Collision Coverage: This covers injury to your car on the occasion of a crash. Irrespective of responsibility.

Comprehensive Coverage: This defends contrary to non-collision events, such as theft. Vandalism, or natural disasters.

Uninsured/Underinsured Motorist Coverage: This provides coverage if you’re involved in an accident. With someone who doesn’t have sufficient insurance.

Homeowners Insurance

Types of Insurance; Homeowners insurance protects your home and personal belongings against damage or loss caused. By events such as fire, theft, vandalism, or natural disasters. In addition to covering the structure of the home. This type of insurance typically includes coverage for individual stuff and liability. Extra living expenditures if your home develops filthy.

Insurance delivers financial refuge by pooling capital from numerous policyholders. Through Financial insurance even expenses. Persons defend themselves from possible dangers and wounded. Premiums, deductibles. Claims are the essential mechanisms of insurance attention. These basics help you pilot and make the most of your safety.

Proprietors insurance can vary in footholds of what it housings and how plentiful protection is available. Normal rules typically cover compensations produced by shared dangers, such as fire, theft, and storms. However, sure proceedings like deluges or tremors may require distinct attention.

Renters Insurance

Types of Insurance; Occupant insurance is similar to owner insurance. But it is intended for persons who rent their homes or flats rather than possessing the goods. Renters insurance delivers attention for individual possessions in the occasion of robbery, fire, or injury. as well as responsibility defense if somebody is hurt on your borrowed stuff.

It is a reasonable way to protect your properties and defend them physically from surprising prices. Yet renter’s insurance is not continuously compulsory by landlords, it is extremely optional. as it can offer amity of mind in circumstances of chances or tragedies. That may touch your possessions.

Disability Insurance

Types of Insurance; Disability insurance delivers financial provisions on the occasion that you are powerless to effort owing to disease or wound. It substitutes a share of your revenue while you are improving and powerless to earn a alive. Disability insurance tin can be short-term or long-term. Dependent on the distance of attention.

Insurance shelters an extensive variety of wants. From fitness and life health insurance coverage to auto and homeowners’ attention. Apiece-type proposals are unique defenses contrary to exact dangers. Safeguarding monetary concord of attention. Thoughtful the changes amid rules can help you select the right care. Discover your choices for complete and reasonable insurance answers.

Short-Term Disability Insurance: This type of insurance shelters a temporary incapacity and classically provides welfare for a few months.

Long-Term Disability Insurance: This type provides welfare for lengthy eras. Often until the policyholder is talented enough. to reappear to work or reaches the superannuation stage.

Disability insurance is chiefly significant for individuals. Who trust in their revenue to shelter living expenditures and have little investments to fall spinal on.

Travel Insurance

Types of Insurance; Travel insurance is intended to cover unexpected proceedings. That may happen while itinerant, together nationally and globally. It can include attention for journey annulments, postponements, lost baggage, medical disasters, and more. Travel insurance is helpful for anybody itinerant to safeguard.

That they are economically sheltered in case something goes wrong throughout the journey. Approximately travel insurance plans also propose coverage for spare removals, natural disasters, or terrorist bouts. However, travel insurance is not obligatory. It can deliver concord of attention and save cash in the occasion of a spare.

Pet Insurance

Types of Insurance; Pet insurance is intended to help shelter veterinary expenditures in case your pet develops unkind or hurt. It characteristically shelters medical actions such as operations, diagnostic tests, medications, and spare carefulness. There are numerous kinds of pet insurance tactics. With accident-only coverage, complete attention, and wellness tactics.

Pet insurance can help handle the rising price of veterinary care. Particularly for persons with pets that necessitate recurrent medical politeness or have long-lasting health circumstances.

Business Insurance

Types of Insurance; Business insurance assistances defend businesses from monetary loss produced by unexpected proceedings. Businesses face many risks, such as property injury. Legal obligations, employee wounds, and loss of revenue due to disturbances. Business insurance characteristically comprises numerous types of attention, such as:

General Liability Insurance: This shelters legal expenditures and compensations subsequent from rights of negligence, injury, or property injury.

Property Insurance: This protects the bodily assets of the commercial. Such as constructions, equipment, and catalogs.

Workers’ Compensation Insurance: This shelters medical costs and lost salaries for staff who are wounded on the job.

Business Interruption Insurance: This recompenses for lost revenue owing. To unexpected proceedings like normal tragedies or fires. That is provisionally near the commercial.

Umbrella Insurance

Types of Insurance; Umbrella insurance delivers additional obligation attention outside the bounds of your current rules. Such as auto or proprietor’s insurance. It helps defend your possessions on the occasion of a big right or claim. For example, if you are complicated in a plain car chance. that surpasses the restrictions of your auto insurance. Umbrella insurance can protect against the change.

This type of insurance is particularly useful for persons. With considerable possessions or persons who face advanced risks of existence impeached. Insurance is a vital instrument in defending both individuals and businesses after financial dangers. Understanding the numerous types of cover can help you make knowledgeable choices.

Which rules the best outfit your supplies? Whether you’re observing to protect your health. Defend your property, or safeguard your family’s financial safety. There is an insurance strategy intended to propose the defense you essential. By assessing your individual and specialized dangers. You can select the correct attention and avoid unforeseen financial weights.

Shaving an insurance claim is a dynamic procedure when feeling damage or injury. The insurance assesses the state and recompenses the policyholder, therefore. The rights procedure can vary contingent on the type of assurance. The harshness of the occurrence. To study how to fold a right and ensure you obtain the provision you need visit insuranceaims.com to solve the problematic eras.

Comments

Post a Comment